Debates over bank interest rates often unfold as subtle power plays: one client wins 3 basis points, another celebrates marginally better terms. But what does the third do?

Imagine two institutional players: one sticks to traditional banks, relying on fixed-term deposits with annual interest rates ranging from 5.75% to 6.5%. Meanwhile, the “third” explores modern financial instruments - cryptocurrency lending, where annualized yields can reach 18-20%, depending on the digital asset and liquidity pool.

For institutional investors, this is not merely a matter of choosing a higher percentage; it’s about evaluating liquidity, risk-adjusted returns, operational efficiency, and regulatory compliance.

The question is not which is “better” in isolation, but which infrastructure allows a firm to maximize yield while maintaining operational control and transparency.

When there’s a significant amount of capital on the table, the question of where to place it goes far beyond personal finance. A bank is usually the first option that comes to mind. And if that’s where your thoughts are headed, imagine being presented with the following choices:

• Barclays - balance £1 million+, 1.46% AER

• Revolut - up to 3.51% AER¹

• HSBC - balance $50,000+, 3.69% AER

At first glance, placing capital in a bank deposit seems straightforward - sign the papers, lock the funds, collect the interest. In practice, it’s an operational ecosystem of compliance layers, approvals, and procedural friction.

Once a deposit option is chosen, execution follows a predictable corporate pattern: internal approvals, KYC updates, compliance validation, and multiple document rounds. Each step is designed for security, yet collectively, they translate into latency - both administrative and financial.

Interest technically begins to accrue upon activation, but real yield realization often depends on how efficiently the process moves through verification cycles. Minor administrative delays, fee structures, and liquidity holds quietly erode the nominal return.

Consider a $1 million allocation at a 3.69% annual rate - the monthly yield is approximately $3,075. The outcome is fully compliant, low-risk, and entirely predictable. Stability is the reward, but so is the cost: the opportunity curve remains flat, with no dynamic yield optimization or compounding potential.

Traditional banking yield remains a cornerstone of capital preservation - conservative, regulated, and deliberately slow. It’s ideal for maintaining liquidity and demonstrating fiscal discipline.

But in an era defined by real-time markets, tokenized assets, and institutional DeFi infrastructure, this approach increasingly serves as a baseline, not a benchmark.

The workflow for institutional crypto lending is streamlined: no branches, no paper stacks - just access the platform and your capital is ready for deployment.

Let’s assume you have $1 million. In crypto lending, you can distribute your funds across multiple tokens with different annual yields, fixing the terms and periods:

The product allows for both standard and institutional crypto deposit plans.

• Standard plans: for example, USDT up to 18.64% - 10-360 days (fixed) - deposit range is 50-600,000 USDT; BTC up to 17.39% - 10-360 days (fixed) - deposit range 0.05-120 BTC.

• Custom plans: designed for business clients, starting from deposits of 600,000 USDT, offering flexible rates, a wide selection of cryptocurrencies, and robust security measures.

Offers products like Steady Returns, Top Gains, and VIP Exclusive.

• Steady Returns for BTC: fixed APR 0.50%-0.80% for 10-30 days.

• VIP Exclusive: tailored for high-net-worth and institutional clients, offering enhanced flexibility and priority access (exact rates not disclosed publicly).

Supports 300+ crypto assets with flexible and locked options. Popular products:

• Standart plans: ETH (1.42%~455.2%) - flexible/locked; USDT (4.2%~7.27%) - flexible/locked durations.

• Advanced Earn: offers diversified strategies such as Discount Buy Dual Investment, Smart Arbitrage, and On-Chain Yields. Designed for clients seeking higher returns through tactical exposure, providing attractive APR and potential for high yield.

Interest accrues daily, enabling real-time performance tracking. Sharp token price movements can be addressed immediately, reallocating capital to optimize returns. Traditional banks do not provide this level of responsiveness - rates are fixed, and returns are predetermined.

A $1 million portfolio distributed across several coins, averaging 7% annual yield, would generate approximately $5,833 in a single month - a tangible improvement over traditional banking yields with comparable capital.

Crypto lending is not a replacement for banking infrastructure but a complementary tool for institutional investors. It allows active portfolio management, agility, and yield optimization, aligning capital deployment with the pace of modern financial markets.

|

Advantages: For institutions, managing risk is a daily discipline. Traditional bank deposits offer credit certainty: regulatory oversight, insured deposits, and structured recourse mechanisms. Your capital is safe, and the environment is highly controlled.

|

|

Disadvantages: However, predictability comes with subtle trade-offs: interest accrues methodically, operational overhead - audits, transfer procedures, minor fees - quietly erodes returns, and agility is virtually absent. The advantage is clarity and stability; the downside is the inability to capitalize on shifting opportunities. |

Crypto: Agile Potential

|

Advantages: Digital asset markets paint a contrasting picture. Yields are attractive, execution is flexible, and markets operate 24/7. Institutional-grade DeFi and exchange platforms have even engineered solutions to some of the crypto risks that may arise: Multi-Party Computation (MPC) disperses key management, reserve funds safeguard against unexpected losses, and integrated insurance plus internal controls reduce exposure to counterparties.

|

|

Disadvantages: Crypto opportunities carry distinct challenges: • Rapid and sometimes extreme price swings • Counterparty and protocol risk • Technology and cybersecurity exposure |

A bank provides certainty, operational simplicity, and peace of mind - an anchor for risk-averse capital. Crypto offers latitude, dynamic yield optimization, and direct control, demanding sophisticated governance and active oversight.

The choice is less about right or wrong, and more about aligning instruments with strategic priorities and appetite for calculated risk.

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

Solana is showing a bullish engulfing candlestick that could drive prices toward $150. Analysts forecast a potential 600% surge for XRP if market momentum strengthens.

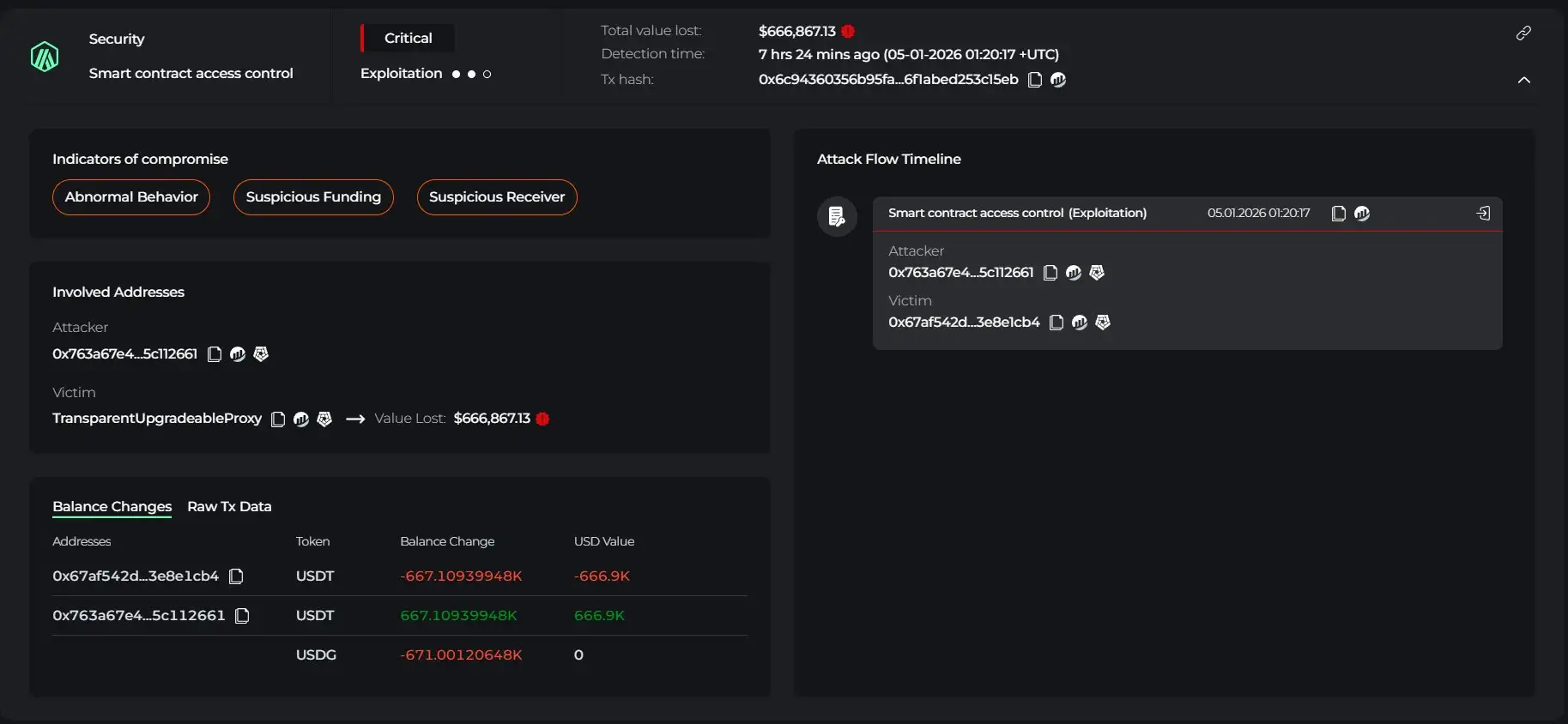

Cyvers detects deployer account compromise, funds bridged to Ethereum and laundered through Tornado Cash. Latest DeFi security incident on January 5, 2026.

Revolut’s 2017 “experiment” is now the fintech standard. Neobanks, marketplaces & apps are all adding crypto to boost revenue, retention & user growth.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases