Tradefi.bot, the decentralized trading infrastructure powered by artificial intelligence, has successfully closed a $20 million round led by Rollman Management, marking a major milestone in its global expansion.

The project is on a mission to redefine how traders and people interact with markets, by merging AI, DeFi, and Web3 into a single ecosystem that delivers transparency, automated trading, and scale.

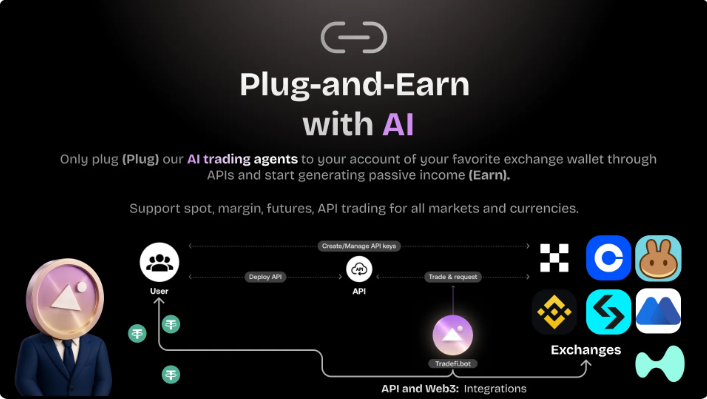

Tradefi.bot is a non-custodial AI-driven ecosystem that enables anyone to deploy AI Trading Agents (decentralized bots) capable of executing automated strategies 24/7 across leading CEXs and DEXs (including OKX, Binance, Bybit, and Bitget).

Unlike traditional systems, users retain full control of their funds via API connections, while the AI Agents analyze markets, place trades, and optimize portfolios autonomously.

With more than 44,000 monthly active users without launched token, Tradefi.bot has already demonstrated strong organic traction and undeniable product-market fit.

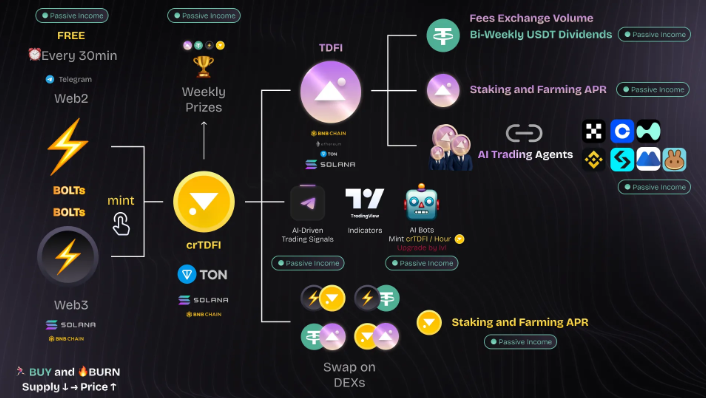

At the heart of the ecosystem is $TDFI, Tradefi.bot’s native token:

With its fixed supply and rising demand, $TDFI is designed as the financial engine that powers the entire Tradefi.bot ecosystem.

Tradefi.bot is audited by CertiK and SolidProof, achieving a Code Security Score of 78.59 and amassing over 23,000 votes on CertiK Skynet, ranking among the Top 10 most-voted global projects.

All trading strategies are publicly available and verifiable on TradingView, with over 10 years of backtested data, boasting a 75% win rate and low drawdowns.

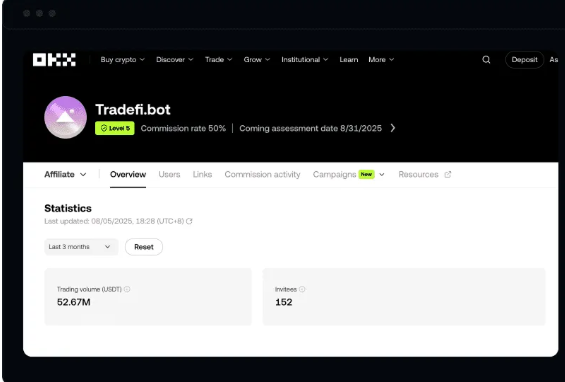

Over $52M in real trading volume on OKX alone has already proven $TDFI’s economic engine — this isn’t speculation, it’s live.

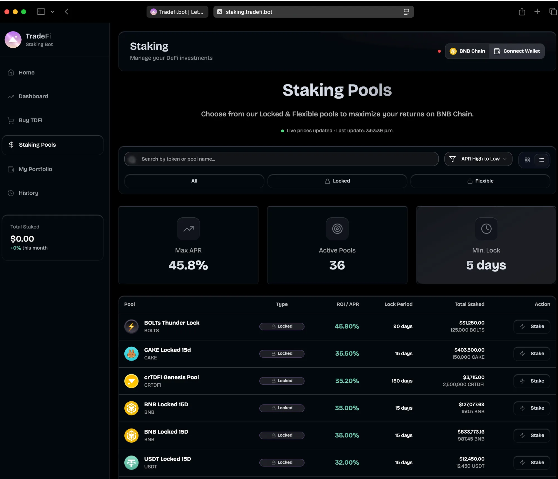

The ecosystem includes:

According to Victor R. Ch. Rollman, CEO of Rollman Management:

“Tradefi.bot is the first AI-driven ecosystem designed to deliver consistent returns with real trading volume and decentralized security. We’re witnessing the future of automated investing.”

The mission is clear: drive crypto to new all-time highs, not only through speculation or HODL strategies, but through a real liquidity engine powered by AI automation.

Tradefi.bot recently secured a $20M Token Subscription Facility with Rollman Management . The funding will be strategically deployed across marketing, development, treasury management, and large-scale deployment of AI Trading Agents.

A portion will also seed the Tradefi Investment Fund, designed to generate sustainable profits that are distributed as biweekly USDT dividends to users.

This partnership provides Tradefi.bot with a decisive advantage in the DeFi space, combining institutional backing with cutting-edge AI-driven infrastructure. The team is also working on a decentralized futures platform powered by AI Agents, positioning itself as a potential “Hyperliquid killer” in the next market cycle.

Tradefi.bot Deploy AI Trading Agents on Blockchain and Redefine Passive Income in DeFi

$TDFI is not “just another token.” It represents the world’s first Decentralized Exchange-Traded Fund (dETF), designed as the core infrastructure of Tradefi.bot — a non-custodial, AI-powered ecosystem that enables automated trading across both CEXs and DEXs.

Unlike traditional cryptocurrencies such as Bitcoin, $TDFI cannot be mined. Instead, every time it is used to activate an AI Trading Agent (bot) or to access advanced ecosystem tools, the token is burned, reducing overall supply and reinforcing a deflationary design where scarcity increases as adoption scales.

This positions $TDFI as a utility-driven token tightly integrated with Tradefi.bot’s technology, capturing value from real ecosystem activity, AI-powered trading strategies, and cross-exchange automation.

Tradefi.bot recently secured $20 million in strategic funding led by Rollman Management, providing the resources to accelerate its next phase of growth. This capital is being allocated to expand AI Trading Agent deployment, enhance blockchain integrations, and strengthen the platform’s security and infrastructure.

The funding also supports the development of new features such as cross-exchange automation, decentralized risk management, and multi-chain compatibility, ensuring that Tradefi.bot continues to innovate at the intersection of AI, DeFi, and Web3.

By focusing on sustainable infrastructure and long-term scalability, Tradefi.bot is positioning itself as a leader in the next generation of AI-powered blockchain ecosystems.

Everything in the Tradefi.bot ecosystem is powered by $TDFI, which functions as the central utility token enabling access to the platform’s AI-driven infrastructure. Through $TDFI, users can:

All strategies within the ecosystem are public and verifiable on TradingView, backed by more than 10 years of backtested data, achieving a 75% win rate with minimal drawdowns — highlighting the platform’s emphasis on transparency and performance validation.

Tradefi.bot’s AI Trading Agents have demonstrated strong performance in backtesting and live environments, highlighting their reliability and efficiency:

These results, publicly verifiable on TradingView, underscore the project’s commitment to data transparency and strategy validation. By making all strategies auditable, Tradefi.bot ensures that users and developers alike can evaluate performance and risk with clarity.

Within the Tradefi.bot ecosystem, value creation is tied directly to the activity of AI Trading Agents across both centralized and decentralized exchanges. Fees, spreads, and commissions generated by these agents flow back into the network, fueling its sustainability.

Key mechanisms include:

This design establishes a deflationary model, where higher ecosystem usage results in more trading activity, more token burns, and greater reinforcement of network value.

➡️ This is what makes $TDFI structurally bullish.

This framework ensures that $TDFI follows a deflationary design, where increased usage naturally reduces supply and strengthens the token’s role within the Tradefi.bot ecosystem.

$TDFI functions as the gateway token of the Tradefi.bot ecosystem — required to activate, interact with, and scale the platform’s AI and DeFi capabilities.

$TDFI is more than just a token.

It serves as the core utility layer of Tradefi.bot — an AI-powered, decentralized trading ecosystem designed to integrate automation, transparency, and blockchain infrastructure for the next generation of digital finance.

Strategic Partners & Network

Exchange Affiliates: OKX, Bitget, Binance, Bitunix, Bybit Upcoming Exchange Listings: Gate.io, MEXC, BitMart, LAToken, CoinStore, Toobit, P2B, Dex-Trade, Azbit. Technology Partners: Google for Startups, Amazon Web Services (AWS), TradingView, Chainlink Marketing: m3tamedia, DTC Group, IBC Group, Mario Nawfal Launchpads: Spores Network, BSCS, TrustFi, KingdomStarter (KDG), SiriusPad, OpenPad, Huostarter, ZenixAccelerators: Thrive Protocol, ApeBond, Psalms CapitalVenture Capital: Rollman Management, Nimbus Capital, CLS.Global. Market Makers: CLS.Global, Yellow Capital, Klein Labs, Kairon Labs Other Partners: PinkSale, GemPad, SolSale, Finceptor, Decubate Supported Blockchains: Solana, BNB Chain, Ethereum, TON

🌐 Website: https://tradefi.bot

📢 Telegram: t.me/TradefibotChat

🐦 X / Twitter: x.com/Tradefibot

📲 App: https://t.me/tradefibot_appbot

✈️ Free Beta: AI Trading Signals (Telegram List): https://t.me/addlist/FYfFKDhqUgQ5MGFh

🆓 Free Beta: AI TradingView Indicators:

https://t.me/TradingView_Access_Indicator_Bot

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

I compared Kraken, WhiteBIT & Coinbase to show which fits your business best.

VibeFunnel launches an AI platform that boosts landing page conversions with automated testing, real-time insights, and brand-consistent design.

If you think money will look the same in 10 years, you’re seriously underestimating technological progress.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases