Key Insights:

Sam Bankman-fried says his biggest regret was handing FTX over before he could secure rescue funds.

FTX collapsed in Nov. 2022 due to misuse of user funds by Alameda.

Creditors have received $7.8B in repayments; $8.7B more expected.

Sam Bankman-Fried, the jailed founder of collapsed crypto exchange FTX, have commented on his biggest mistake before his arrest. According to him, his “single biggest mistake” was handing the company over to new leadership.

In a new interview with Mother Jones, SBF revealed he had been approached about a potential last-minute investment just minutes after signing away control of the exchange in November 2022 but by then, it was too late.

The firm’s new CEO, John J. Ray III, immediately filed for bankruptcy and brought in legal counsel from Sullivan & Cromwell to begin restructuring.

FTX’s collapse, which resulted in an $8.9 billion hole in customer funds, stemmed from Bankman-Fried's mismanagement and unauthorized transfer of assets to sister trading firm Alameda Research. He was convicted on seven felony charges and is now serving a 25-year sentence.

Ahead of SBF’s appeal hearing this month on November 4, FTX has so far repaid a total of $7.8 billion to creditors across three repayment rounds, including a $1.6 billion payout on September 30.

The estate, now managed by Ray and a court-appointed team, aims to repay at least 98% of customers 118% of their original balances as recorded in November 2022.

The exchange is estimated to have recovered up to $16.5 billion in assets, leaving around $8.7 billion still to be returned. Many creditors are hopeful, but the complex bankruptcy case continues to unfold nearly three years after the initial collapse.

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

Solana is showing a bullish engulfing candlestick that could drive prices toward $150. Analysts forecast a potential 600% surge for XRP if market momentum strengthens.

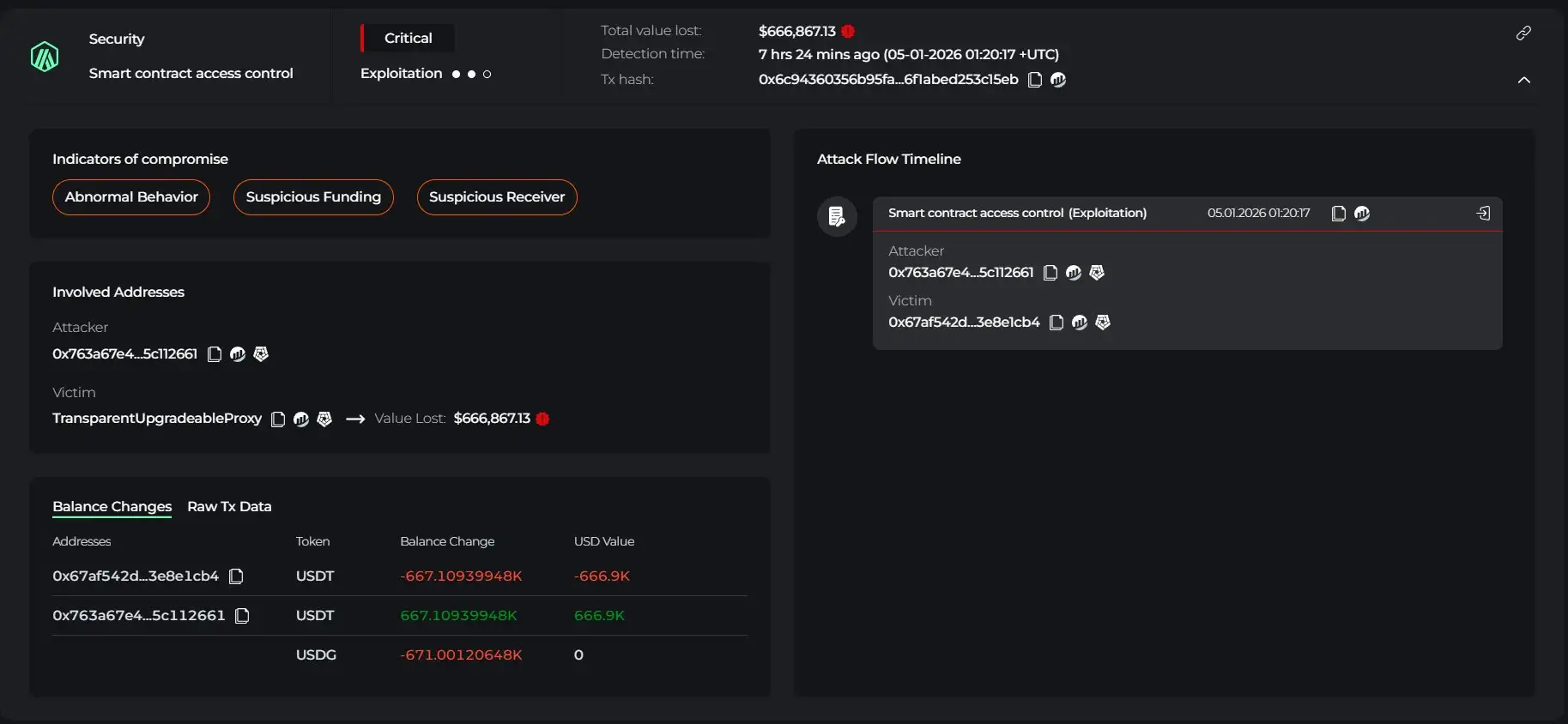

Cyvers detects deployer account compromise, funds bridged to Ethereum and laundered through Tornado Cash. Latest DeFi security incident on January 5, 2026.

Revolut’s 2017 “experiment” is now the fintech standard. Neobanks, marketplaces & apps are all adding crypto to boost revenue, retention & user growth.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases