Key Insights:

Crypto investment products saw a record $5.95 billion in weekly inflows, led by Bitcoin’s $3.6 billion surge amid U.S. shutdown fears.

Ethereum, Solana, and XRP also posted historic inflows, with altcoin ETF approvals potentially driving future investor interest.

Total assets under management in crypto funds hit a new all-time high of $254.4 billion, signaling strong institutional confidence.

Cryptocurrency investment products just posted their largest-ever weekly inflows, with a massive $5.95 billion flowing into crypto exchange-traded products (ETPs) as of Friday.

The historic surge was largely driven by investor anxiety over macroeconomic instability, including fears of a potential U.S. government shutdown, delayed responses to monetary policy, and disappointing employment data.

According to CoinShares' blog post, the week’s inflow shattered the previous record of $4.4 billion set in mid-July, marking a 35% increase. Notably, the previous surge had been more evenly distributed between Bitcoin and Ethereum.

This time, Bitcoin dominated, attracting $3.6 billion in inflows alone, a new record for BTC-focused products.

The data points to a growing perception of Bitcoin as a safe-haven asset in times of fiscal uncertainty, echoing similar behavior seen during past macro crises. As investors lose confidence in traditional systems, especially with ongoing gridlock in U.S. governance and potential funding delays, crypto assets are viewed as uncorrelated hedges against systemic risk.

“Despite prices closing in on all-time highs during the week, investors did not choose to buy short investment products,” said James Butterfill, head of research at CoinShares. “This suggests confidence that prices will continue to rise.”

While Bitcoin led the charge, Ethereum ETPs also saw impressive participation, pulling in $1.48 billion during the same week. That brings Ether’s year-to-date inflows to $13.7 billion, nearly triple the amount seen in 2024 and further reinforces its growing institutional appeal ahead of potential Ethereum ETF approval in the U.S.

Solana (SOL) came in third with $706.5 million in inflows, while Ripple recorded $219.4 million, both marking their highest weekly totals ever. These numbers come as several ETF applications for altcoins, including SOL and XRP are still under regulatory review.

Approval could serve as a catalyst for capital rotation from Bitcoin into these high-potential assets, particularly as investors seek diversification during bullish phases.

Crypto analysts suggest that once regulatory clarity emerges, especially around altcoin-based ETFs, investor interest could spike. Increased capital inflows into altcoins may drive prices upward, sparking renewed momentum and potentially triggering the next leg of the altseason.

Reflecting the surge in demand, total assets under management (AUM) in crypto investment products have now surpassed $250 billion, hitting an all-time high of $254.4 billion. This milestone shows the high amount of capital entering digital assets, especially from institutional and wealth management channels.

With the U.S. macro environment uncertain, and global interest rate policy shifting, crypto is emerging as both a speculative growth asset and a portfolio risk hedge. For now, the floodgates appear open, with digital assets enjoying one of their most bullish institutional waves yet.

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

Solana is showing a bullish engulfing candlestick that could drive prices toward $150. Analysts forecast a potential 600% surge for XRP if market momentum strengthens.

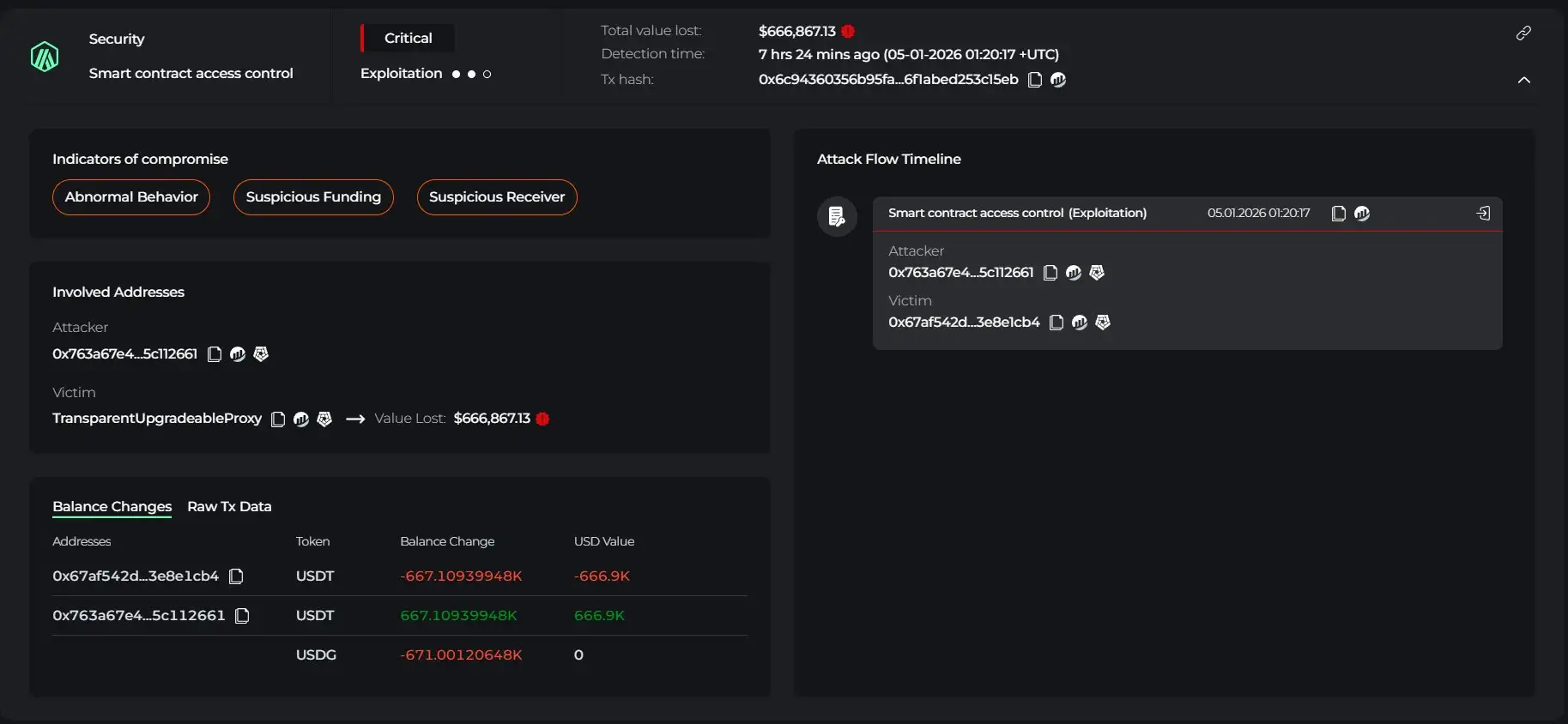

Cyvers detects deployer account compromise, funds bridged to Ethereum and laundered through Tornado Cash. Latest DeFi security incident on January 5, 2026.

Revolut’s 2017 “experiment” is now the fintech standard. Neobanks, marketplaces & apps are all adding crypto to boost revenue, retention & user growth.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases