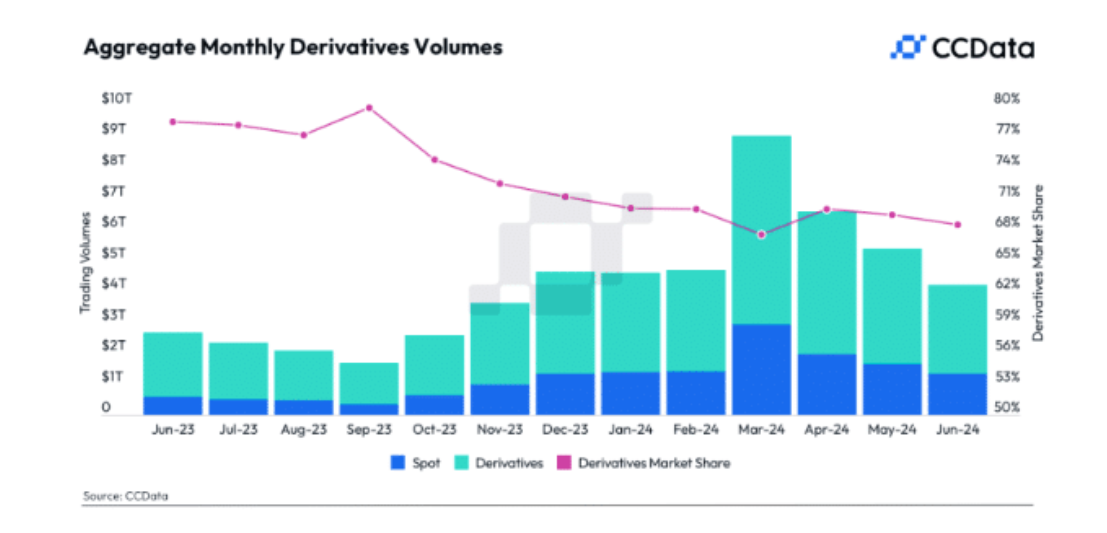

The trading volume on cryptocurrency exchanges has been on a steady decline for the past three months, now sitting at $4.22 trillion, a steep 53% drop from March's figures.

The downward trend began in April, with a report from CCData highlighting a 33% drop in spot trading volume on exchanges that month.

Crypto derivatives trading also fell by 26%, marking the first decline in seven months.

This drop followed a bullish market performance at the year's start, peaking in March with a combined spot and derivative trading volume of $9.05 trillion.

However, this momentum did not last. By June, the trading volume saw a significant reduction of more than 20%, with the combined spot and derivatives trading volume falling by 21.8%, cutting March's figures in half to $4.22 trillion.

Spot trading alone plummeted by 19.3%, reaching a low of $1.3 trillion in June, down from around $3 trillion in March.

This decline also impacted Open Interest, which fell by 9.76% on derivative exchanges to $47.11 billion.

Additionally, the Chicago Mercantile Exchange (CME), the largest institutional derivative exchange, experienced an 11.5% drop in futures trading volume, hitting $103 billion, with ETH options taking the hardest hit.

The overall decrease in trading volumes has also affected Binance, the largest centralised exchange, which saw its market share drop by 9% over the past year.

In July 2023, Binance held a 40.4% share, which has now decreased to 31.2%.

The market's strong performance at the beginning of the year slowed after March, leading to irregular market conditions, frequent declines, and neutral investor sentiment.

This continued decline in trading volumes and the reduction in market share for leading exchanges like Binance highlight the current challenges and cautious sentiment within the crypto market.

In conclusion the consistent decline in crypto exchange trading volumes over the past few months underscores a challenging period for the market.

With spot and derivatives trading volumes significantly reduced and major exchanges like Binance experiencing a drop in market share, investor confidence appears to be wavering.

The market's initial bullish momentum has tapered off, resulting in a more cautious and uncertain environment.

As the crypto market navigates these challenges, the coming months will be critical in determining whether it can regain its previous levels of activity and investor confidence.

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

Revolut’s 2017 “experiment” is now the fintech standard. Neobanks, marketplaces & apps are all adding crypto to boost revenue, retention & user growth.

Circle USDC, led by Nima Elmi, holds early talks with the Nigeria's Ad Hoc Committee on Cryptocurrency.

Volatility drives trader behavior. See how major exchanges use targeted competitions to channel market chaos into structured trading volume.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases