CEX Hard No-Gos

Now let’s weigh each exchange by volume, product stack, security posture, and real-user feedback:

With roughly $21.4 B in daily turnover, Binance still commands the deepest liquidity pool on Earth. Its May 2025 Merkle-tree PoR confirmed 100 % backing for BTC, ETH, USDT, plus 30-plus other assets, so balance-sheet strength looks intact.

Flagship products include Binance Launchpad, Binance Earn , Binance Alpha, and Binance Pay , and uptime is reliable aside from that 23-minute AWS blip . Community sentiment? Mixed. Trustpilot pulled the public score over waves of fake reviews, though Capterra users still cheer its liquidity and feature breadth.

Bottom line: If you crave top-of-book depth and constant new listings, Binance remains the size king—just expect the occasional gear grind.

WhiteBIT pushes $2.3B of trading volume a day (roughly $2.7 T yearly) across 330+ coins and underpins an ecosystem valued near $38.9 B. A Hacken-audited, real-time on-chain PoR delivers my favorite flavor of transparency. Beyond 190 spot/futures pairs, the lineup features the WhiteBIT Nova crypto card with 1 % cashback, Auto-Invest, Whitepool, Crypto Lending, Crypto Borrowing native WBT Coin, with market cap of about $4.5 B, and a WhiteBit Launchpad.

Review score: 3.6 / 5 on Reviews.io, with shout-outs for steady feature rollouts.

Takeaway: One of the rare platforms genuinely nipping at Binance’s heels—already ahead on some metrics and closing fast on others.

Daily volume sits near $3.5 B across 725 coins and 1,186 markets—solid depth even after February’s $1.4 B hack. Bybit Copy Trading, Bybit Launchpad, Bybit Earn, Bybit Card with 10% cashback and Crypto Loans.

Trustpilot lingers at 2.6 / 5; repeated frozen-account complaints drag sentiment down, and the Lazarus-linked hack still stings. Proof-of-reserves is self-issued, not third-party—my personal deal-breaker.

Verdict: Attractive for derivatives hunters chasing razor-thin funding rates, but I cap deposits until an independent PoR appears.

Kraken handles about $1.1 B in daily trades across 120-plus assets and sports a March 2025 Merkle-tree PoR (114.9 % BTC coverage) from The Network Firm.

Feature list is slim — AutoEarn, Kraken = Subscription with zero fees, and Recurring Buys.

Trustpilot clings to 1.4 / 5 (slow support, withdrawal lags), though Reddit veterans report “zero issues since 2018.”

Snapshot: Feels armor-plated, but too vanilla and sluggish for my rhythm.

Around $1.2 B in daily volume and a staggering 1,191 coins make KuCoin the hunting ground for early-stage tokens. Wallet holdings are streamed live, yet no external audit—PoR confidence = “trust me, bro.” Feature roster:KuCoin Earn, KuCard Crypto Debit Card, KuCoin SharkFin, KuCoin Pay, KuCoin Crypto Lending and KuCoin SnowBall--plenty to play with.

Reviews.io pegs it at 2.1 / 5, with scam-recovery spam cluttering comments (including a £100 k loss highlighted as “most helpful”).

Summary: Never dull and rich in alt-coins, but my security bar keeps it in watch-only mode.

So, Which CEX Wins?

Hacks, outages, and fake-review purges prove there’s no universal champ—only exchanges that align with your risk profile. Crunching the numbers above, WhiteBIT tops my list and, crucially, has never suffered a hack — a security résumé that speaks for itself.

Trade on micro-second speed? Chase the lowest latency you can ping. Parking a long-term stack? Insist on a live PoR you can verify. Do the homework, read the fine print, and choose the exchange that nails your non-negotiables before you hit “Deposit.”

On-Chain Media articles are for educational purposes only. We strive to provide accurate and timely information. This information should not be construed as financial advice or an endorsement of any particular cryptocurrency, project, or service. The cryptocurrency market is highly volatile and unpredictable.Before making any investment decisions, you are strongly encouraged to conduct your own independent research and due diligence

Tags :

0 Comments

Show More

Solana is showing a bullish engulfing candlestick that could drive prices toward $150. Analysts forecast a potential 600% surge for XRP if market momentum strengthens.

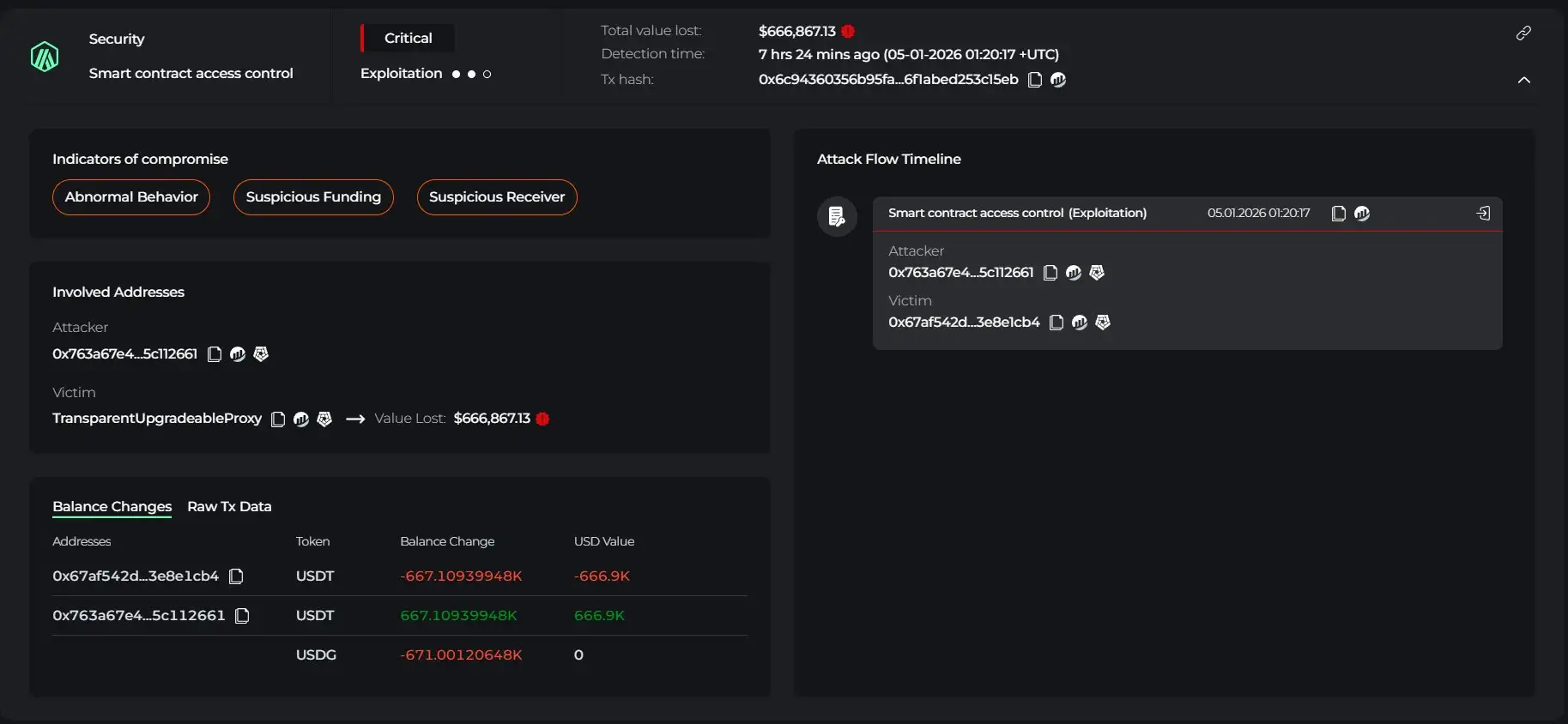

Cyvers detects deployer account compromise, funds bridged to Ethereum and laundered through Tornado Cash. Latest DeFi security incident on January 5, 2026.

Revolut’s 2017 “experiment” is now the fintech standard. Neobanks, marketplaces & apps are all adding crypto to boost revenue, retention & user growth.

On-Chain Media is an independent, reader-funded crypto media platform. Kindly consider supporting us with a donation.

bc1qp0a8vw82cs508agere759ant6xqhcfgcjpyghk

0x18d7C63AAD2679CFb0cfE1d104B7f6Ed00A3A050

CBaXXVX7bdAouqg3PciE4HjUXAhsrnFBHQ2dLcNz5hrM

Contains the last 12 releases